wyoming llc tax rate

Tax Rate 0. For residential and commercial property the tax collected is 95 percent of the value of the property.

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Additional State Capital Gains Tax Information for Wyoming.

. State wide sales tax is 4. Wyoming corporations still however have to. See the publications section for more information.

Average Sales Tax With Local. The states base rate is 4. Ad Northwest Registered Agent fronts you the state fees.

For any income under 60000 the graduated tax rate is between 22 to 555 The maximum income tax rate is 660 on income of 60000 or over. Get Privacy by Default superior customer service from Corporate Guides LLC docs more. Because the Wyoming sales tax rate is low.

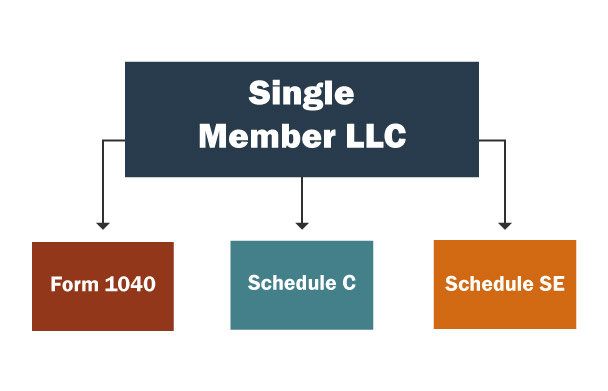

First a legal LLC in the US with one member has a default tax status of tax disregarded entity for tax purposes as noted in. Wyoming does not place a tax on retirement income. Answer 1 of 3.

The tax is calculated at a rate of two-tenths of one mill on the dollar based on the value of your LLCs. Each year youll owe 50 to the State of Wyoming to keep your Wyoming company. Corporate Tax Rate Rank.

Delaware also charges a franchise tax. This will cost you 325 for a corporation or an LLC. Individual Income Tax Rank.

Wyoming has one of the lowest median. This is the state. Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report.

In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Wyoming does not have state or local capital gains taxes. 51 rows 10 BEST states to form an LLC or corporation in 2021.

The annual report fee is based on assets located in Wyoming. Tax rates are provided by Avalara and updated monthly. The tax is either 60 minimum or 0002 per dollar of.

This tax is administered by the Federal Insurance Contributions Act FICA which covers Social Security. All members or managers who take profits out of the LLC must pay self-employment tax. Sure I can address your tax questions.

2022 List of Wyoming Local Sales Tax Rates. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. A variable rate IRA CD offers tax-free or tax-deferred interest.

Wyoming has no corporate income tax at the state level making it an attractive tax haven for incorporating a business. Youre guaranteed only one deduction here effectively making your Self. The state of Wyoming charges a 4 sales tax.

And local governments can add on to the base. Dont pay more get more. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent.

This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state. We include everything you need for the LLC. If you are not resident in the US your Wyoming LLC will only pay tax on US-sourced income.

The median property tax in Wyoming is 058 of a propertys assesed fair market value as property tax per year. Up to 25 cash back In conjunction with the annual report you must pay a license tax. LLC profits are not subject to self-employment.

The Combined Rate accounts for the Federal capital gains rate the. LLCs under a C-Corporation election that accumulate and do not. Look up 2021 sales tax rates for Ethete Wyoming and surrounding areas.

Lowest sales tax 4 Highest sales tax 6 Wyoming Sales Tax. Annual Report License tax is 60 or two-tenths of one mill on the dollar 0002 whichever is greater based on the companys assets located and employed in the state of Wyoming. Best Variable Rate IRA CD Rates in Wyoming WY.

Wyoming LLCs pay a 30 percent tax on all income from US. Ad Northwest Registered Agent fronts you the state fees. A Wyoming LLC also has to file an annual report with the secretary of state.

Additionally counties may charge up to an additional. For industrial lands this percentage goes up to 115 percent. Then you are going to like this tax advantage of Wyoming.

Wyomings tax system ranks. With corporate tax treatment the LLC must file tax return 1120 and pay taxes at the 2018 corporate tax rate of 21 percent. Tax amount varies by county.

Wyoming has state sales tax. Get Privacy by Default superior customer service from Corporate Guides LLC docs more. Dont pay more get more.

The tax rate is 20 percent the rate is reduced to 15 percent for certain specific items Accumulated Earnings Tax. Compare the best variable rate IRA CD rates from banks in Wyoming WY.

Llc Tax Calculator Definitive Small Business Tax Estimator

Filing A Schedule C For An Llc H R Block

Limited Liability Company Llc And Foreign Owners Epgd Business Law

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Choose Your Llc Tax Status Truic

Wyoming Sales Tax Small Business Guide Truic

Beer Tax In America Infographic Beer Facts Beer Industry Beer

True Cost To Start A Wyoming Llc Optional Required

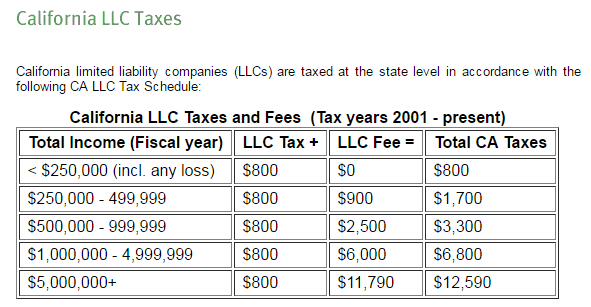

Ftb Notice Of Balance Due For Llcs Dimov Tax Cpa Services

Llc Tax Calculator Definitive Small Business Tax Estimator

Wyoming Tax Benefits Jackson Hole Real Estate Ken Gangwer

Llc Taxes Single Member Llc Taxes Truic

10 Best States To Form An Llc Infographic Business Infographic States Infographic